Sometimes, the housing data headlines tell just half the tale. The stories on May’s Housing Starts figures are proving to be a terrific illustration.

Sometimes, the housing data headlines tell just half the tale. The stories on May’s Housing Starts figures are proving to be a terrific illustration.

Tuesday, the Census Bureau released its monthly Housing Starts report. A “housing start” is a home on which construction has started.

The report is separated by property type with a separate count for single family homes such as detached residences and town homes; for multiple-unit homes such as 2-unit, 3-unit and 4-unit structures; and, for buildings of 5-units of more such as new condominiums. Continue reading

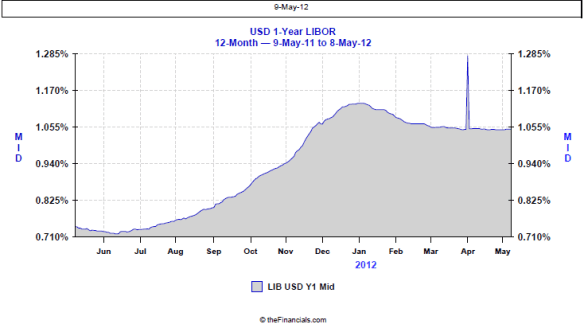

Mortgage markets worsened slightly last week as demand for mortgage-backed bonds slacked. There was little surprise in U.S. economic data and the unfolding story lines of the Eurozone

Mortgage markets worsened slightly last week as demand for mortgage-backed bonds slacked. There was little surprise in U.S. economic data and the unfolding story lines of the Eurozone

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday.